By Shah Gilani,Shah Gilani – Total Wealth Research, 2024-07-24

A Note From Amanda: In this edition of Buy This, Not That… Shah's looking at a sector that outperforms during the months of July and August.

But before you dive in… you need to see Shah's just released research on what he's calling “Undefeated Stocks” – stocks that produce gains like clockwork.

If you're interested in getting his No. 1 pick for August – a stock that has averaged double-digit gains in the month of August for five straight years – click here.

The healthcare sector pumps trillions of dollars through our economy's veins each year.

But not all healthcare stocks deserve a spot in your portfolio.

From weight loss wonder drugs to household staples… we're putting five pharmaceutical heavyweights to the test.

Are their stock charts showing signs of good health… or do they need intensive care?

We're looking at a pharma giant with a sky-high P/E ratio… a dividend darling that could be living beyond its means… one that might need to call a Code Blue on its finances… and more.

Which of these pharma stocks hands out a prescription for portfolio health?

And which ones should be quarantined?

It's all in the latest episode of Buy This, Not That… your exclusive guide to the stocks that are worthy of your money – NOW.

Click on the thumbnail below to dive in.

TRANSCRIPT

Eli Lilly (LLY)

Hey, everybody. Shah Gilani here with your weekly BTNT, as in Buy This, Not That.

This week, we're going to talk about the big five pharma companies because I've gotten a lot of requests as to whether or not they're BUYs. Some of them had really good moves so far this year. Some of them are not looking so good. So let's take it from the top.

But and we'll start off with, it's Wednesday, so Wednesday as I record this. Wednesday morning, the market's just open, and we're seeing a little selling here. So I'm going to first start by bringing up the S&P 500, and then we're going to look at each of the stocks that I'm going to be talking about.

So here we go. Here's the S&P5 00. And as you can see, a pretty good looking chart until we get to, oh, we got a little bit of selling going on here. And this to me is a bit worrisome because we've had such a tremendous ride.

Are we going to get to see something like this that we saw back here in April where we saw a 7% sell down over here? Yeah. We collected ourselves. It got back up.

This is looking rather reminiscent of what happened in early April.

We got earnings coming out. Tesla earnings just, I would say, pooped out, and the stock's getting hit. Google, pretty good earnings, but the market didn't like it, and Google's selling off. Now we got rest of the big tech names coming up.

Of course, we got lots of names coming up. But right now, earnings so far, the numbers are the names have come out about 7% to 10% of the S&P 500 have come out pretty good. Nothing to really sneeze at in terms of misses, but nothing to really cheer in terms of beats. But so far, so good.

Nonetheless, we're seeing what we've been seeing for the last several quarters. We are seeing companies that don't do well or miss or just don't guide well get hit.

So with that said, the drug companies, as they come up, they're going to be in the line of fire. So the first up is the big boy, Eli Lilly, LLY. Lilly is the largest in terms of market cap, big pharma drug company in the United States, frankly, in the world. So take a look at the stock price.

It's trading at $858. Now down 2.5% this morning. Again, it's rather reminiscent of what happens in the S&P 500, which is why I showed you that. It's rolling over a little bit here.

Now, Eli Lilly long term is going to be a buy, but I wouldn't buy it in here, folks. This is a $790 billion market cap company, 18% profit margins.

The thing that I don't like about is their trailing P/E right now is up 129. That's crazy. Forward P/E is 64, which says their earnings should pick up, and the price may be worth it down the road. But still, that's awfully steep for a drug company.

Just want to caveat that it's drug companies that we're going to talk about today. All of them are going to go chase the weight loss drugs because that's where the market is going to be for the foreseeable future. They're all going to be into that if they're not into it already. They're going to go after companies and buy companies and small companies and their partnerships with companies that have these weight loss drugs.

That's really across the board. They're all going to be involved not because they have to. So I'm not going to single any one of them out because they have maybe a lead for the time being because that's all going to change. But there's no really decent dividend with Lilly.

I wouldn't chase it up here. You know, you see this recent high here. That's not that long ago. That's on, July 15, which bunch of them made in the mid-July new high.

So nothing unusual there, but that was a high intraday of $966. We're down at $858, people. That's a big drop. That's worrisome.

So as far as Lilly goes, you know, I would buy it around $800. Do I think it can get to $800? Yeah. Why would why do I think $800?

Because then we're coming down here. We're coming down to this range where there should be some support. If it breaks there, well, maybe we can get down to $714. I'm not going to chase it, and I don't think you should either.

But at some point, Lilly's a buy. If you want to wait, if the stock gets down to $700, close to $700, $725, it's absolutely a buy long term. But right now, don't chase it.

Johnson & Johnson (JNJ)

Next up, Johnson & Johnson, JNJ.

J&J, and everybody knows J&J. I'm sure you've got some J&J products, some Johnson & Johnson products in your cabinet right now. $366 billion market cap. Up today as opposed to Lilly being down today. Profit margin here, 17%.

Very diversified company, not just healthcare, not just drug development, but household products, healthcare products across the board. So, I think a wider, I'm going to call it a wider, offering of of products, across the spectrum that is so broad that you can't help but like Johnson & Johnson. But you look at the chart, it's like, well, it's not really doing much. In fact, it's not looking that good. On a two-year basis, it looks worse.

But I like it. P/E is 23.

So forward P/E is 15. I like it. Now we got down here. We got some some lows there, and I think we could test that.

Now this again, we're going back to April here, and the intraday low is $143. The stock's at $153.92 right now. If you like Johnson & Johnson, and I do, I'm going to wait to see if I can get it down here in maybe, like, $142. Just I'm going to try and buy it on the low, and then it's a long-term hold.

But right here, it's not acting great. Again, you got the little rollover here. Now it's starting to start to do well. Got above the 200-day.

Rolls over. Once it rolls back over, let's see if it breaks down again. So it's not a buy right now, especially if the market's a little shaky. I would wait on Johnson & Johnson, but I'd certainly buy it down here, in the low $140s for sure.

Merck (MRK)

Next up, Merck, MRK.

Merck is another one of those – its trailing P/E to me is ridiculous at $138. That's not even expensive. That's bizarre. And look at this stock chart.

A lot of flatlining here lately. Alright? Then it looks like if it's going to roll over, it's going to break down here. If it breaks down below the, I would say, the support at $120 and change, it's going to go test the moving average immediately at $119.

So would I buy Merck in here? No. It's had a nice little run so far, but is the only thing that's maybe worth it? And by the way, profit margin is 3.73%, so it's not one of the better, healed as far as profit margins goes.

But, again, as far as the the trailing P/E, 138, I wouldn't touch it because of that. Oh, forward P/E, according to Yahoo, 14. I don't think the earnings are going to come up that much, Yahoo, and anybody else who thinks it's got a 14 forward P/E on that. That's unsustainable. Ain't going to happen.

I think it could test $120. Would I buy it down here at $120?

No. I'd want to see where it goes. Because if Merck gets down to $120, something's wrong. Maybe something's wrong with the market.

Maybe the market's weighing on it. Maybe something's wrong with Merck. Maybe the earnings come out and then they disappoint. So, yes, it's a buy, people, but, you know, a lot of these drug stocks, as far as application of capital, they're slow movers for the most part.

There's a lot of places where you can get a lot of better better return on your capital. So these long term, you like to hold them. There are places to buy them, and I think Merck, to me, it's a lot lower. I would buy it at $110, and it will be a hold for me.

Amgen (AMGN)

Next up is Amgen. AMGN.

Amgen has a $178 billion market cap. Profit margin, about 12.75%. So pretty decent there. The forward P/E is 17. The trailing is about 47. So a lot more reasonably priced.

And the chart is sloppy. Admittedly, if you look at all this action here, this is not something that to me instills confidence. Oh, yeah. Nice.

A new high just recently. Alright. July 18. What we do? It was $338 intraday.

We're at $331 now. Can Amgen continue to go higher?

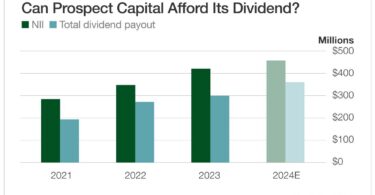

No. I don't think so. I think it's got a problem paying its dividend. The dividend yield is is 2.47%, which is not much.

But they don't have enough net income available to common shareholders to pay that dividend properly. They're borrowing. The payout ratio is 124% of the net income available to common shareholders. So either they gotta make more money to be able to sustain that dividend or borrow to pay that dividend.

That's not a good equation on a stock that's just kinda made a new high. There's a huge gap here, people. I'd be worried about that gap. If I'm going to buy Amgen and I would buy it, it covers that gap down around $280, I'd be a player in Amgen from there because then you got some support down here at $260.

So, yeah, I would buy $280 with the $260 view to maybe add because long term, Amgen's probably going to do really well.

Pfizer (PFE)

Last but not least, Pfizer PFE. Pfizer has a $167 billion market cap.

I'm just going to make this easy for you.

Don't buy this. It's first of all, it's an ugly chart. I know. It looks like it's going to bounce and it's above its 200-day. I know what you're going to say looking at the chart. Oh, why doesn't Shah like it here? How about the profit margin is negative? -0.56%.

Yeah. Good luck with that. So no. For that alone, I'm not going to buy a drug company that's struggling that mightily. It's oh, by the way, it's got a dividend, a really handsome dividend yield, 5.69%. Woohoo.

But as far as net income available to common shareholders, which is the metric against which you judge the payout, the ability to pay out the dividend, is negative.

They don't have any money. They're negative on net income available by $288 million-plus. So where are they getting the money to pay the dividend?

The dividend payout ratio, that is, how much of the net income available to common shareholders they are actually taking to pay the dividend is 433%. Unsustainable dividend. It's going to get cut. So Pfizer, don't waste your money on Pfizer.

At some point, yeah, let's see if it breaks down. I'll revisit it with you guys.