By Greg Patrick, Trades Of The Day,Trades Of The Day, 2024-09-11

I Just Bought Visa (V) For The Income Builder Portfolio

by Greg Patrick

In today's update I'm going to be walking you through the details of my latest purchase for the Income Builder Portfolio.

If you follow along with our chat, then you know that I just bought Visa (V), which is a brand new position for the IBP.

I'll get to the purchase details and an overall portfolio update in a moment. Before I get to that, I want to address what I'm sure is going to be a concern that many of you have about Visa: Its very low yield.

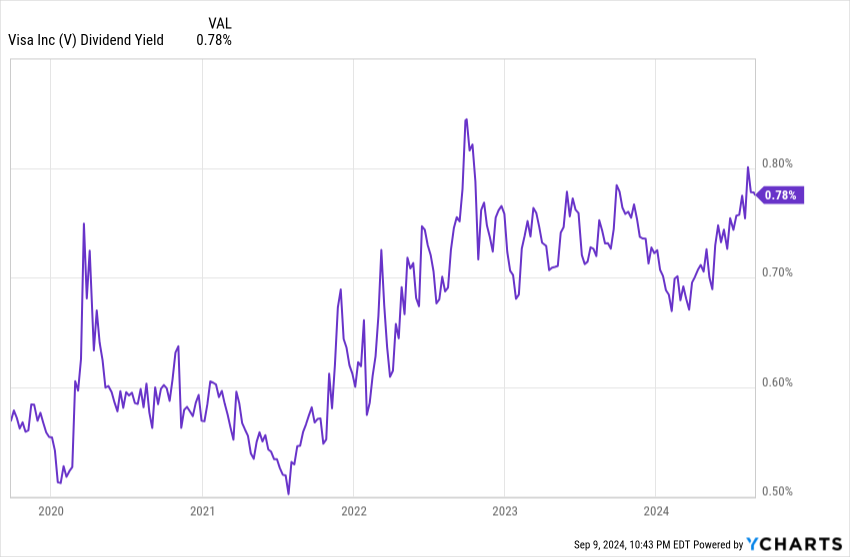

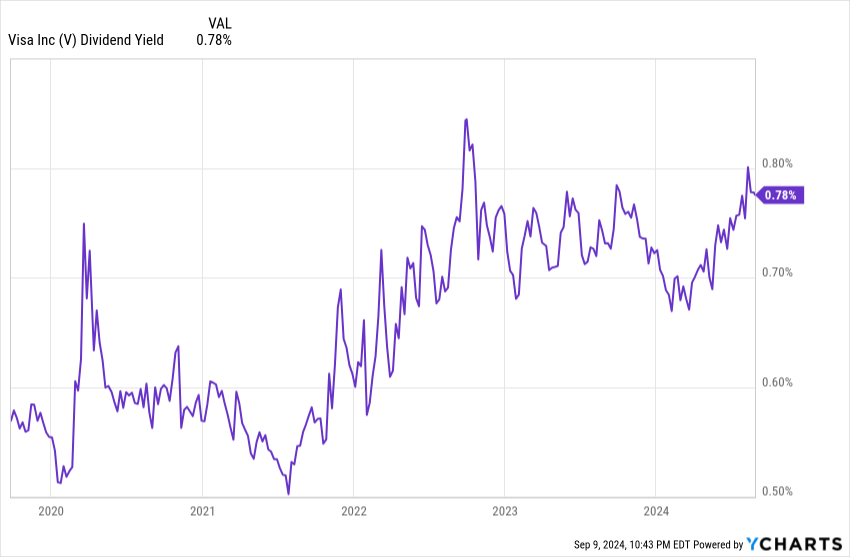

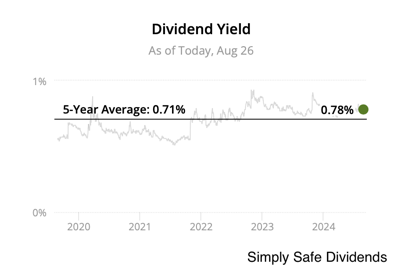

As I write, Visa pays $0.52 per share per quarter. At recent prices, that puts its annual dividend yield around 0.78%. That's a really low yield. Especially in today's high rate environment where you can get risk-free (or virtually risk-free) yields of around 4-5%.

So why would I even consider such a low-yielding stock for the Income Builder Portfolio?

Before I answer that, I'm going to echo something that Dave Van Knapp and Mike Nadel have preached over and over: We're never going to tell you what you should buy.

What we're doing here is telling you what we're buying in our own portfolios and then explaining a little bit of the reasoning or strategy behind it. That way you can decide if the stock that we're buying is something you think will fit in your own portfolio.

With this in mind, I'm going to simply make a couple arguments for why you may not want to completely overlook Visa — or other stocks like it — on the merit of low yield alone.

I'm mentioning this because Visa's low yield was actually a pretty big concern that I had to address for myself before buying it for the IBP. So I already argued with myself over this concern… and of course, I won!

Argument #1:

Interest rates are coming down and even low-yielders like Visa will look more attractive (and thus attract new money).

Whenever I size up a potential investment, I consider its opportunity cost: What kind of income or return could I get by investing that same money somewhere else?

Lately, with interest rates so high, I tend to compare potential investments to the income I could get from a CD, Bond, Treasury Note or Money Market fund. Up until about a year and half ago or so ago, my wife never owned a CD in her life. But just a couple weeks ago she locked in her third or fourth consecutive CD in the past ~18 months. This time, she bought a 3-month CD through JP Morgan that pays 5.15% and matures November 7.

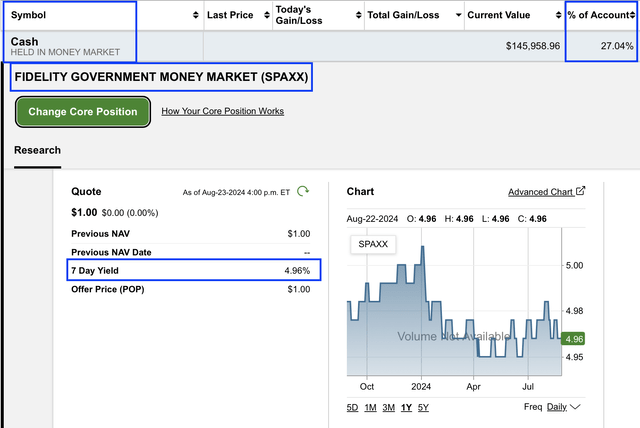

Similarly, for the past 12-months+, I've kept a significant amount of cash in my 401k at Fidelity in their SPAXX Money Market. I currently have $145K, or about 27% of the value of my 401k, earning 4.96% from SPAXX.

Of course, these instruments (CDs, Bonds, Treasury Notes and Money Markets) don't offer any potential upside, so that's something to consider. Still, since rates have been so high, these instruments have been a good choice for safe, high, current income in the short-term, say 12-18 months.

But what happens when rates go down, as we can now expect to soon happen? These income instruments will become much less attractive than they have been, and money will flow out of them.

In other words, fixed income and money market investments won't offer the same appeal for my capital as they have recently. They'll no longer be considered the “opportunity cost” that they have been. And in their place, even low-yielding stocks like Visa will become more attractive/competitive for my money.

That's why I'm getting into Visa now — before rates fall and prices of our favorite dividend growth stocks get driven up. And as for the $145K I currently have in the Fidelity Money Market Fund… that will likely get fully vested in a combination of dividend growth stocks, funds and option income plays.

Argument #2: Visa's yield is heading to a record high.

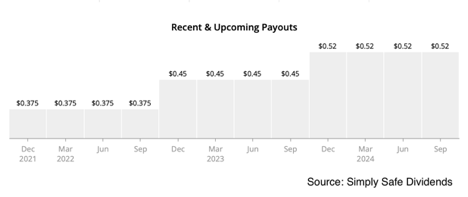

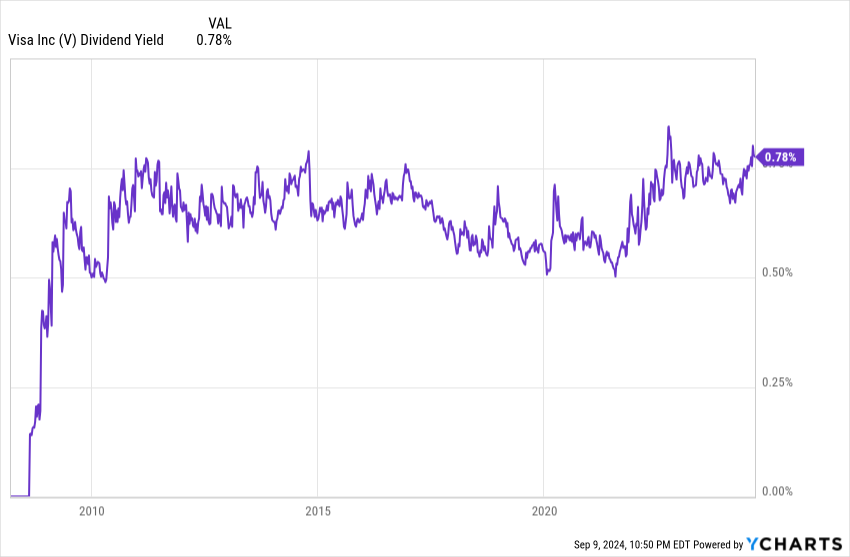

As I mentioned, in absolute terms, Visa's current 0.78% yield is very low. But relative to Visa's own standards, it's actually historically high… and about to get higher. That's because if history is any guide, Visa will be announcing its next dividend hike in the coming months.

The company's most recent increase, in October 2023, was 16% — from $0.45 to $0.52. Even if Visa boosts its next payout by “just” 10%, that will increase its forward yield, based on current prices, to 0.86%. That would be an all-time high yield for Visa.

Again, this is all relative — I realize a sub-1% yield is hardly anything to get excited about!

Argument #3: Consider Visa's yield simply a bonus… the real attraction is its growth potential (which can be converted into future, higher income).

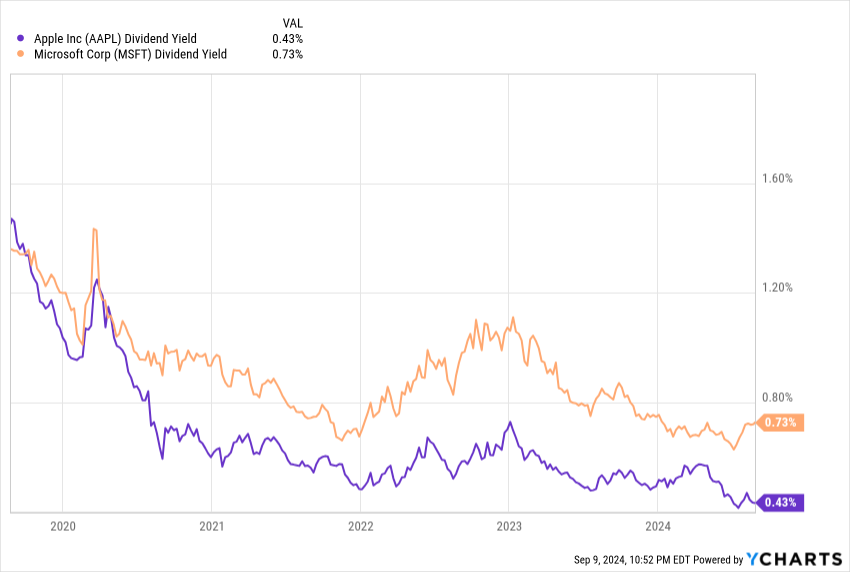

I'll admit, my own argument about Visa's soon-to-be all-time high yield isn't much of a selling point. In the near- to mid-term, I'm considering any income generated from the company to be a bonus. What's ultimately attractive about Visa is that it falls more in the “growth” camp with the likes of Apple (AAPL) and Microsoft (MSFT).

Apple and Microsoft are companies that many income investors have overlooked in the past simply because of their low yields. If you're setting minimum yield requirements on your investments, at any point in time since June 2018 (the beginning of the chart), these companies would have gotten disqualified out of the gate.

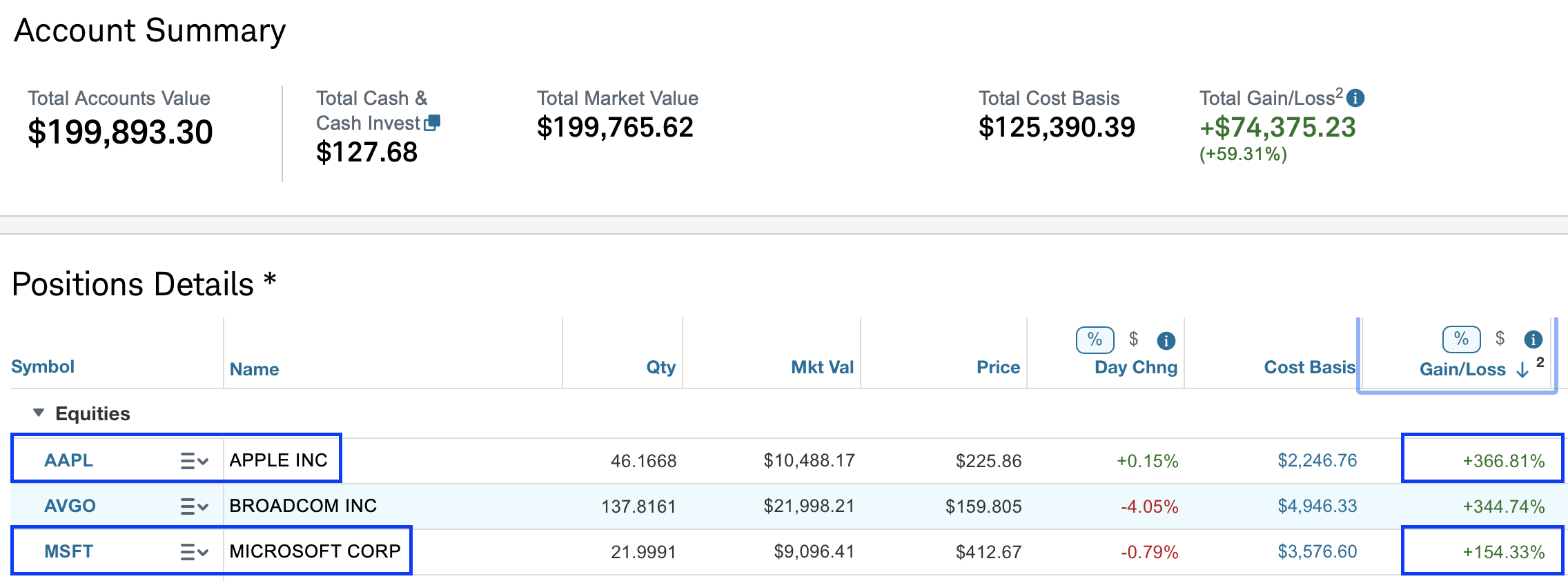

You can probably guess what's coming. Now consider the following screenshot, which I just took from our original Income Builder Portfolio (v1.0).

Apple and Microsoft were purchased in June and July 2018 (that's why I used June 2018 as the starting date for the previous chart), with starting yields of less than 1.8%. And they've since ballooned in value to be among the top 3 performers for the portfolio.

Of course I — like many of you — want (and need) income. But if we don't need it immediately, then sacrificing current income for this kind of potential growth is acceptable, in my opinion, for the short- to mid-term. Here's why: After the stock balloons in value we can take some profits off the table and reinvest the proceeds into stocks with higher current yields, giving us the higher current income we will need at the then current time.

Circling back to Visa, this is precisely the role of this new position within the IBP: I didn't buy it for its low current income… I bought it for the future potential growth with an income kicker along the way. When I need higher current income in the future, or if the position size grows to exceed my comfort zone, I'll take profits and invest in stocks with higher current income at that future time.

With all of this in mind, and considering the current environment — as well as Mike Nadel's recent purchase of Visa for his Growth & Income Portfolio — Visa is indeed the “growth and income” stock I like best right now.

Quality

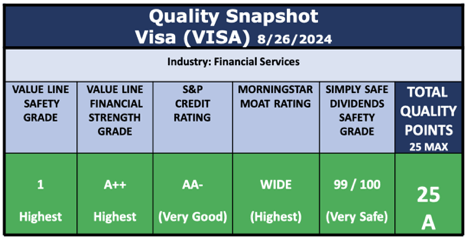

To quickly and consistently gauge the quality of a company, I've taken a liking to the Quality Snapshot rating system developed by Dave Van Knapp.

Dave's system uses five metrics to create an overall point of view on the general quality of a company.

In this regard, Visa gets an “A” grade, ranking it among the highest-quality companies on the market.

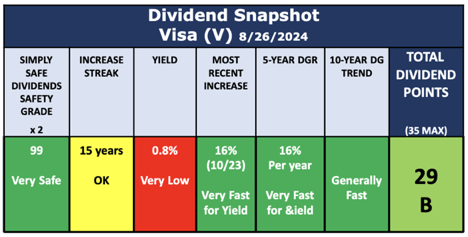

Dividends

Below is how Visa's dividend stacks up. It gets a B rating, which is Above Average. The big dinger here, as I've talked about plenty so far, is its very low starting yield. Over the long-run, I don't anticipate that being problematic for the Income Builder Portfolio.

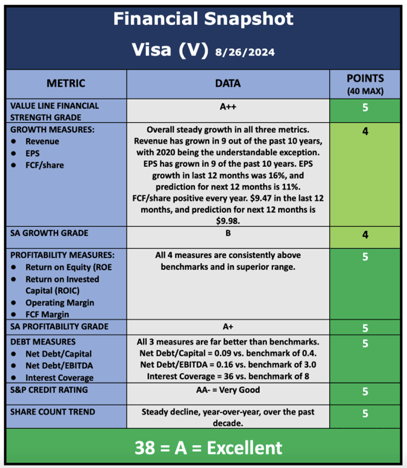

Financials

Visa's Financial Snapshot paints a picture of a company with very strong financials. It gets an “A” rating, which is Excellent.

Valuation

Finally, valuation. This is why Visa looks timely right now.

Valuation Model 1: Current P/E vs. 5-Year Average P/E

Valuation Model 2: Current Dividend Yield vs. 5-Year Average Dividend Yield

Visa's Final Valuation: $293 (9% Undervalued)

Averaging the fair estimates of the three different valuation models we used, we get a final estimated fair value price of $293.

With Visa trading at a recent price of $267.44 per share, that indicates the stock is potentially 9% undervalued.

I'm buying.

Greg Patrick

Source: Daily Trade Alert